Explore India’s Q1 2025 advertising revenue insights—see how top agencies like GroupM and Dentsu performed, which brands led the spend, and what’s driving digital ad growth this year.

India’s advertising industry has kicked off 2025 with remarkable momentum, driven primarily by the explosive growth of digital platforms, strong performances from leading agencies, and heavyweight investments from top brands and conglomerates. Here’s a human-written snapshot of the quarter’s biggest movers and trends in the Indian ad market.

Industry at a Glance

India’s ad sector is eyeing a record-breaking year, projected to hit ₹1.64 lakh crore (₹1,64,137 crore) by the end of 2025. This growth, sitting at roughly 7–8% year-on-year, is powered by aggressive digital strategies, innovation in content, and a rush of spending from dominant sectors like FMCG, e-commerce, banking, and technology.

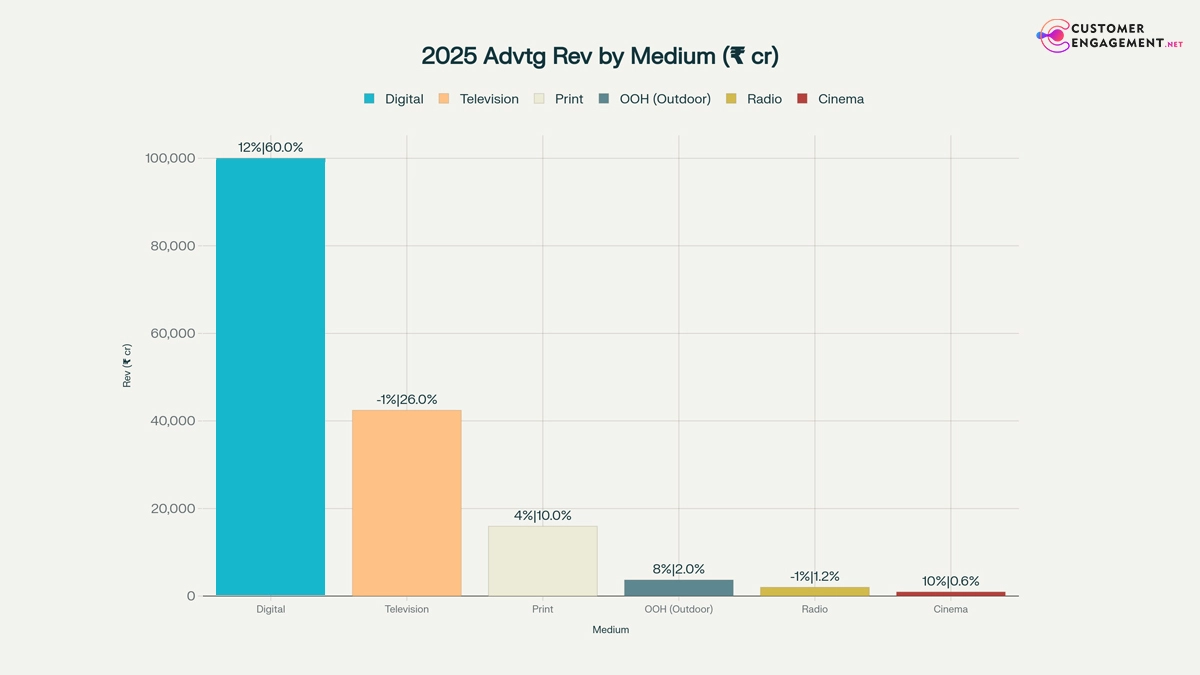

Breakdown by Medium: The Q1 2025 Revenue Story

| Medium | Revenue (₹ crore) | Share of Total | Growth Rate |

|---|---|---|---|

| Digital | 99,137–1,00,000 | 60% | 11.5–12% |

| TV | 42,431 | 26% | -1% (decline) |

| 15,947 | 10% | 4% | |

| Outdoor | 3,671 | 2% | 8% |

| Radio | 2,009 | 1.2% | -1% (decline) |

| Cinema | 942 | 0.6% | 10% |

- Digital is king—now grabbing 60% of all ad spend, as brands pour resources into social, video, and retail media.

- TV is steady but feeling the pinch as digital media accelerates.

- Print is resilient, while cinema and outdoor are staging quiet recoveries.

The Major Agencies: Leaders and Innovators

WPP (GroupM India)

- Commands a large chunk of media buying, especially in digital and TV.

- Top sectors: SMEs, real estate, banking, tech, and education.

Dentsu India

- Digital-first focus, with top clients across FMCG, e-commerce, and automotive.

Other Key Players

| Agency | 2025 Highlights |

|---|---|

| Interactive Avenues | Dominant in digital-only advertising |

| Madison World | Heavyweight in outdoor and integrated media |

| Mindshare (WPP) | Market leader in digital and television buys |

| Ogilvy India | Continues to win for creativity and innovation |

| Havas Media | Excelling in FMCG and performance marketing |

| Publicis Groupe | Gaining ground in customer experience campaigns |

| FCB Ulka | Rides strength in FMCG and automotive sectors |

Major Brands and Conglomerates: Q1 Highlights

- JioStar: Delivered historic revenue, reporting ₹11,222 crore for Q1 FY26, making it the highest ever for an Indian media company.

- CEAT Ltd.: Recorded sales and ad revenue of ₹3,52,070 lakh in Q1, reflecting robust brand investment.

- DB Corp: Achieved ad revenue of ₹397.8 crore, bouncing back post-election season.

- Saregama: Expanded its music and ad business through key catalogue acquisitions.

Leading Advertisers

- Hindustan Unilever Limited (HUL) and Mondelēz India continue to dominate, with Mondelēz earning top digital and social honors in 2025.

- Amazon Ads: Made a splash by winning big at major industry awards and ramping up digital invests.

- Auto & Tech Sectors: Showing over 10% growth in ad spends, solidifying their spots among the top drivers.

Emerging Trends

- Digital Dominance: The pivot to digital advertising is now firmly entrenched, with brands betting big on social, search, and commerce platforms.

- Streaming Rise: Ads on streaming platforms are surging, fueled by affordable options and shifting audience habits.

- Innovation & AI: Agencies are working with AI for sharper ad targeting and campaign optimization, while long-form video ads are gaining traction.

Bottom Line

India’s major ad agencies and top-spending brands are in the midst of a full-blown digital revolution. With digital, streaming, and innovative media solutions leading the way, the country’s ad industry is not just growing—it’s transforming, opening new frontiers for creativity and growth in 2025.